The role of brand in M&A: Technology

The mergers and acquisitions (M&A) market hit recordbreaking growth in 2021 and the first part of 2022, seeing the largest-ever volume of transactions and aggregate deal value globally.

Hope Schmalzried + Aaron Hall

May 2024

What prompted us

From Amazon’s acquisition of MGM to Discovery’s merger with WarnerMedia, this dynamic M&A growth was not only a relative anomaly, but also an environment rich for new brand creation.

As branders with notable success in guiding such world-class companies as Bristol Myers Squibb, Glanbia and the Hewlett-Packard Company through large-scale M&As, we were interested in what this hefty transaction data could tell us about post-deal branding decisions.

More activity in the M&A market creates more opportunity for brands to come together, reposition or rebrand all together. But we wondered: did that increased activity lead to an increased number of net-new brands created over these years? Were companies leaning on co-branding approaches, or more of a pure acquisition strategy? And how, after the hundred-billion-dollar honeymoon period was over, did these companies fare?

What prompted us

What we did

We began our investigation with an S+P Capital IQ data set, which contained all public M&A transaction data in the U.S. from January 2019 to January 2023. This time frame was significant, because it encompassed both pre- and post-Covid M&A activity. We then prioritized the following industries for a deeper look:

Energy

Healthcare

Technology

Financial services

What we did

From there, we defined a set of brand metrics to evaluate for each transaction.

Did the brands:

Create a net-new, post-deal brand?

Remain independent with separate branding?

Follow an acquisition strategy where the purchased company is absorbed into the acquirer brand?

Take a co-branding or endorsed branding approach?

Wait on a branding decision pending full deal transaction?

What we expected to

see

We speculated that each industry would have unique trends and that net-new brand creation would explode during such an active period.

To these hypotheses, the data said both yes and no.

For example, branding decisions can be tracked on an industry-by-industry basis. Take the energy and technology sectors. We concluded that the former was more likely to engage in a pure acquisition strategy, whereas the latter embraced endorsed or co-branding approaches.

Yet as brand creators, we were particularly surprised by the dearth of net-new brands across industries: creation of a net-new brand occurred no more than 2% of the time across selected industries.

So, if a surplus of new-new brands was not the outcome of increased M&A activity, what were the outcomes?

What we expected to

see

What we found

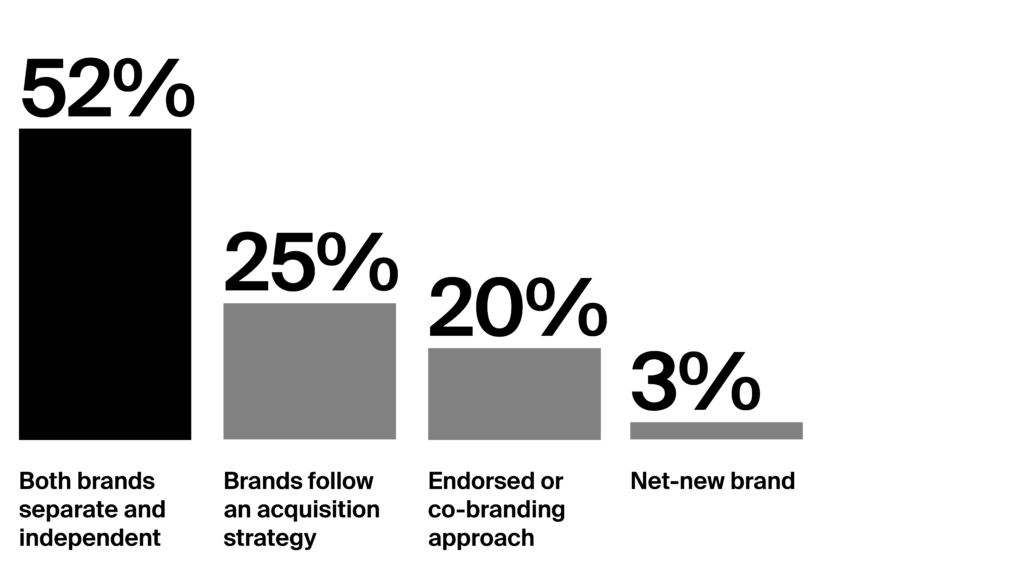

In the technology sector, 52% of M&A transactions led to a separate branding decision, meaning both entities retained their separate branding. Two trends emerged that typified this trend across the sector.

The first trend involved several large, established technology companies purchased another established technology company to deliver on a new use case within the industry. One high profile example of this was Broadcom’s purchase of VMware. Typifying this trend, the technology company being acquired had established enough equity and customer base to retain its own, independent brand. Understandably, VMware built enough credibility in the technology industry to stand as its own product lines within the larger, purchasing company. VMware even brought heightened and timely legitimacy to the parent company by staying independent.

The second trend involved a financial entity (often a private equity firm) purchasing an established technology firm. For example, Thoma Bravo, one of the industry’s largest private equity firms focused on software and technology companies, purchased identity security company ForgeRock – leaving the ForgeRock brand intact.* The same happened when Francisco Partners purchased HR benefits platform bswift from CVS Health. Although bswift retained its own brand, it did also receive a small brand refresh (a tighter logo and more streamlined homepage) and a new CEO (Ted Bloomberg), both of which are highly common with private equity buyouts in the technology space.

*Note, at the time of publishing, PE firm Thoma Bravo has since acquired Ping Identity, another identity security company, and ForgeRock and Ping Identity now share a co-branding strategy

What we found

The second most popular branding decision – at 25% – was a more traditional acquisition strategy, where the smaller, purchased brand is absorbed into the larger purchasing company. This was common when the purchasing company was often solving for a smaller capabilities gap via startup acquisition (unlike the purchase of VMware, which added an entirely new platform offering to the parent company).

For example, in 2021, Neiman Marcus acquired Seattle-based startup Stylyze: a “merchandising-as-a-service” software that improves the online shopping experience through digital outfit and try-on builders, as well as additional content creation tools and more streamlined product attribution data tools. After the acquisition, the Stylyze brand has been fully absorbed, with no remaining website or brand assets, even on the Neiman Marcus online platform. Instead, the Stylyze capabilities have been natively integrated into the Neiman Marcus shopping experience.

20% of the time, more than other industries like healthcare, energy, or financial services – technology sector M&A’s followed an endorsed or co-branding strategy, albeit often with hints at a potential brand integration to come in the future. For example, in May 2022, SalesForce acquired Troops.ai, a revenue communications service provider. Troops retains its name and brand equity, but now has an endorsement modifier underneath the logo: “from Salesforce,” which may be an indication of a migration path for the Troops.ai brand.

In another example, TikTok-rival Triller acquired influencer marketing firm Julius, which is now branded as “Julius by Triller.” The goal of the acquisition was to build out and complete the offerings within the Triller creator network, complete with newer engagement and creator tools. In the shadow of ByteDance’s TikTok empire, complete with ever growing new product lines and spin-offs, the acquisition positioned Triller as a more worthy competitor. Retaining the Julius brand may be a smart move to retainer customers of the acquired brand.

In another example from the identity security industry, Okta acquired Auth0 in 2021. The two websites remain independent, though Auth0 is now endorsed with the tagline, Auth0 “by Okta.”

Only 3% of the time did a technology sector M&A result in a net new brand. While this outcome is uncommon overall, this strategy became useful when multiple platforms/ brands joined into one – instead of pure acquisition approach. For example, in 2021, private equity firm Apax Funds combined three social impact SaaS companies into one: becoming the net new brand, Bonterra. Bonterra brought together EveryAction, Social Solutions and CyberGrants at the start, but has since brought in even more social good technologies to a single, unified, new brand and platform.

In the case of Bonterra— elevating a single, net new brand provided not only clarity, but an opportunity to position as a one stop shop for nonprofit and social impact technology.

The same net new brand outcome was observed in the merger of the managed service provider Verinext, which combined four technology solution innovators: Anexinet, Veristor, Light Networks and SereneIT.

Insights

A few data points from the technology sector are notable when it comes to branding. The first is the influx of private equity acquisitions we saw in the 2019 to 2023 data set. The majority of the time, this meant that the purchased brand was left intact, like ForgeRock acquired by Thoma Bravo, which is common in PE acquisitions.* Yet sometimes, in the case of Bonterra or even bswift, M&A via PE firms presented an opportunity for a brand refresh or net new brand entirely. While the M&A market has slowed down since January 2023, this data set showed a definite uptick of PE investment in technology companies, with a number of opportunities for both brand refreshes and net-new branding.

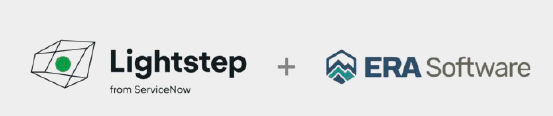

The second notable insight from the technology data set is the use of endorsed or cobranding approaches, as we saw with Julius by Triller and Troops.ai from Salesforce. While in these cases, both brands continue to leverage an endorsed branding strategy, a number of endorsed examples from the data set have already transitioned away from endorsed to full acquisition, proving that endorsed branding can be used as a powerful transitional strategy while the full integration develops over time. For example, at the time of data collection, ServiceNow subsidiary Lightstep (acquired ’21) had acquired ERA Software (acquired ’22), an observability innovator, and decided to use an endorsed branding strategy for the Light step and ERA brands, see below:

In this example we see that Lightstep is provided from ServiceNow, yet retains its own branding.

Yet at the time of publishing, in December 2023, both Lightstep and Era have been absorbed fully into the overarching ServiceNow brand, as part of their Cloud Observability offering. See below.

Insights

Overall, we observed far more uses of cobranding or endorsement line strategies in technology than in the other three sectors we investigated. This may be for any number of reasons including more sensitivity to losing customers from the acquired company, common practice within the industry, typical negotiation tactics during the M&A process, acknowledging the time between when the actual technology platforms are integrated, the retention of culture and people, and more. Whether one or all of these reasons, the trend to cobrand or endorse a retained acquisition brand is a strategy we witness more prominently in technology.

How brand can drive

success

The most outwardly visible role of brand in M&A is the change—or lack thereof—made to a company’s name or logo. Think hyphens and abbreviations that run rampant and amalgamated visual identities that read more chaotic than cohesive. Because this metric of change is so easily visible, it formed the foundation for our analysis of our M&A data.

Beyond changing those important identifiers, there is other, more nuanced and powerful brand work that can be done to ensure success of a new joint entity—for leveraging brand increases the likelihood of success of the merger or acquisition.

A merger or acquisition is a perfect opportunity to revisit a company’s mission, vision and values. What’s more, with new capabilities provided by the event, it is the perfect time to refresh the brand strategy and competitive positioning.

How brand can drive

success

One way to do so is to embrace brand-led organizational change. By assessing each company’s culture and creating a careful plan for integrating the best aspects of both entities, companies can optimize cultural integration, employee engagement, operational efficiency and productivity. Engaging employees of both companies with a clear EVP and uniting them around a new shared goal yields better financial outcomes.

While an increase in M&A activity globally and in the U.S. was notable, even more notable were the resulting branding outcomes. Where we expected to see an increase in net-new brands created, we were surprised to see no new-new brands created in the U.S. industry sector (because of M&A). Retaining separate brands was far more represented in the energy sector than other industries we reviewed. As our energy experts explained, more mature companies in the industry tend to take a more steady and patient approach to brand merging or absorption during M&A.

However, whether two companies change their names or logos or not, there is still important culture and employee brand work that energy companies can embark on during the M&A process to ensure cultural integration, employee engagement, and operational efficiency.

Where do you stand?

Was brand integration discussed as part of the M&A negotiations?

Do you have M&A brand guidelines?

Have you had any internal conversations about brand integration strategy?

Do you have current equity research on both of the brands?

Has your research indicated whether either brand can stretch into the other brand’s territories?

Have you considered the cost of a brand change (both brand creation and brand implementation)?

Have the cultures of both companies been reviewed / analyzed for symmetries and best practices?

Where do you stand?