The role of brand in M&A: Energy

The mergers and acquisitions (M&A) market hit record-breaking growth in 2021 and the first part of 2022, seeing the largest-ever volume of transactions and aggregate deal value globally.

Hope Schmalzried + Aaron Hall

July 2023

What prompted us

From Amazon’s acquisition of MGM to Discovery’s merger with WarnerMedia, this dynamic M&A growth was not only a relative anomaly, but also an environment rich for new brand creation.

As branders with notable success in guiding such world-class companies as Bristol Myers Squibb, Glanbia and the Hewlett-Packard Company through large-scale M&As, we were interested in what this hefty transaction data could tell us about post-deal branding decisions.

More activity in the M&A market creates more opportunity for brands to come together, reposition or rebrand all together. But we wondered: did that increased activity lead to an increased number of net-new brands created over these years? Were companies leaning on co-branding approaches, or more of a pure acquisition strategy? And how, after the hundred-billion-dollar honeymoon period was over, did these companies fare?

What prompted us

What we did

We began our investigation with an S+P Capital IQ data set, which contained all public M&A transaction data in the U.S. from January 2019 to January 2023. This time frame was significant, because it encompassed both pre- and post-Covid M&A activity. We then prioritized the following industries for a deeper look:

Energy

Healthcare

Technology

Financial services

What we did

From there, we defined a set of brand metrics to evaluate for each

transaction.

Did the brands:

Create a net-new, post-deal brand?

Remain independent with separate branding?

Follow an acquisition strategy where the purchased company is absorbed into the acquirer brand?

Take a co-branding or endorsed branding approach?

Wait on a branding decision pending full deal transaction?

What we expected to see

We speculated that each industry would have unique trends—and that net-new brand creation would explode during such an active period.

To these hypotheses, the data said both yes and no.

For example, branding decisions can be tracked on an industry-by-industry basis. Take the energy and technology sectors. We concluded that the former was more likely to engage in a pure acquisition strategy, whereas the latter embraced endorsed or co-branding approaches.

Yet as brand creators, we were particularly surprised by the dearth of net-new brands across industries: creation of a net-new brand occurred no more than 2% of the time across selected industries.

So, if a surplus of net-new brands was not the outcome of increased M&A activity, what were the outcomes?

What we expected to see

What we found

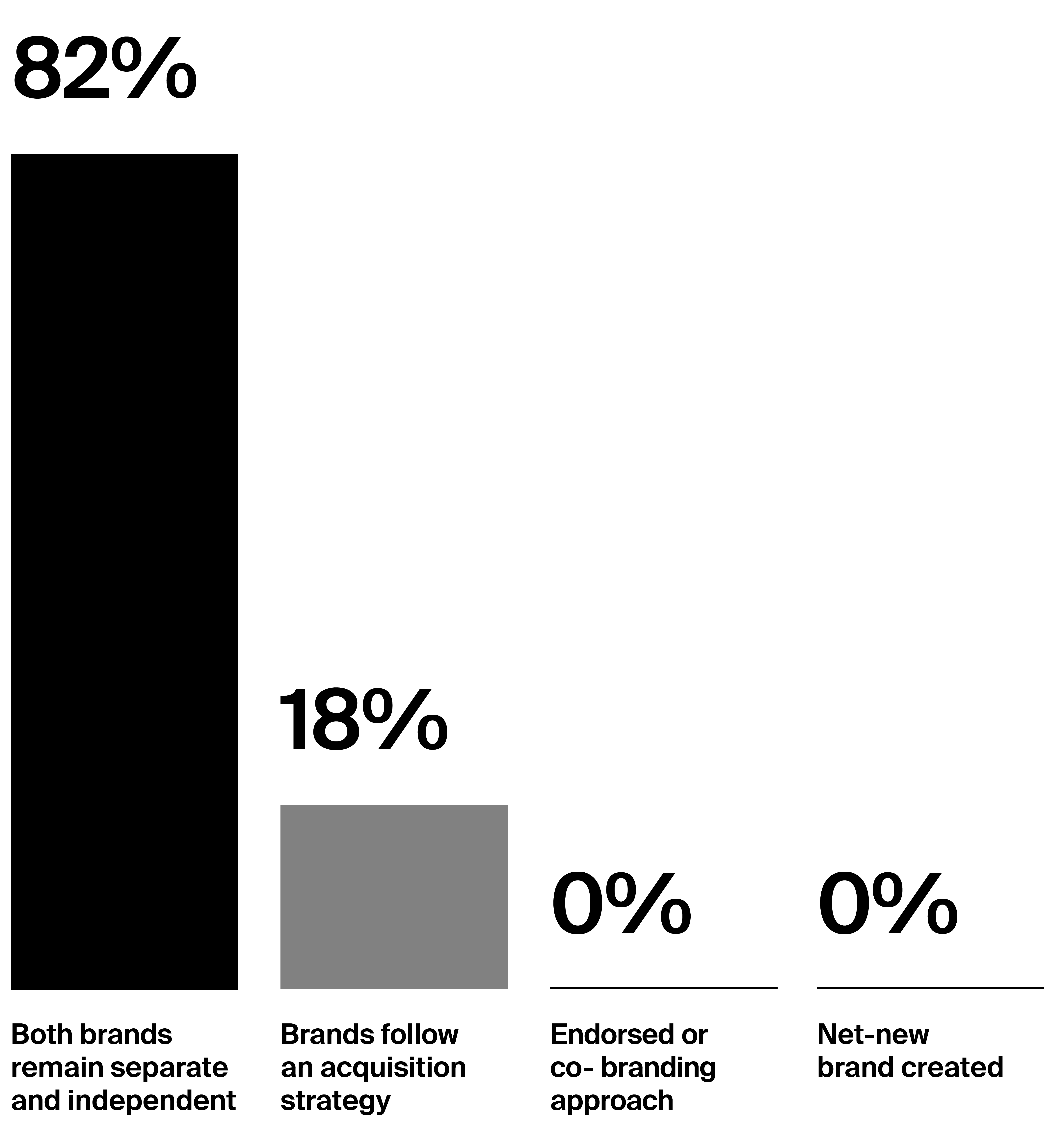

M&A in the energy sector was the least common in our selected data set, making up just under 3% of the U.S. M&A transactions from 2019 to 2023. And of that selection, 82% of transactions—a significant majority—chose a branding decision where both entities remained independent with separate branding.

What we found

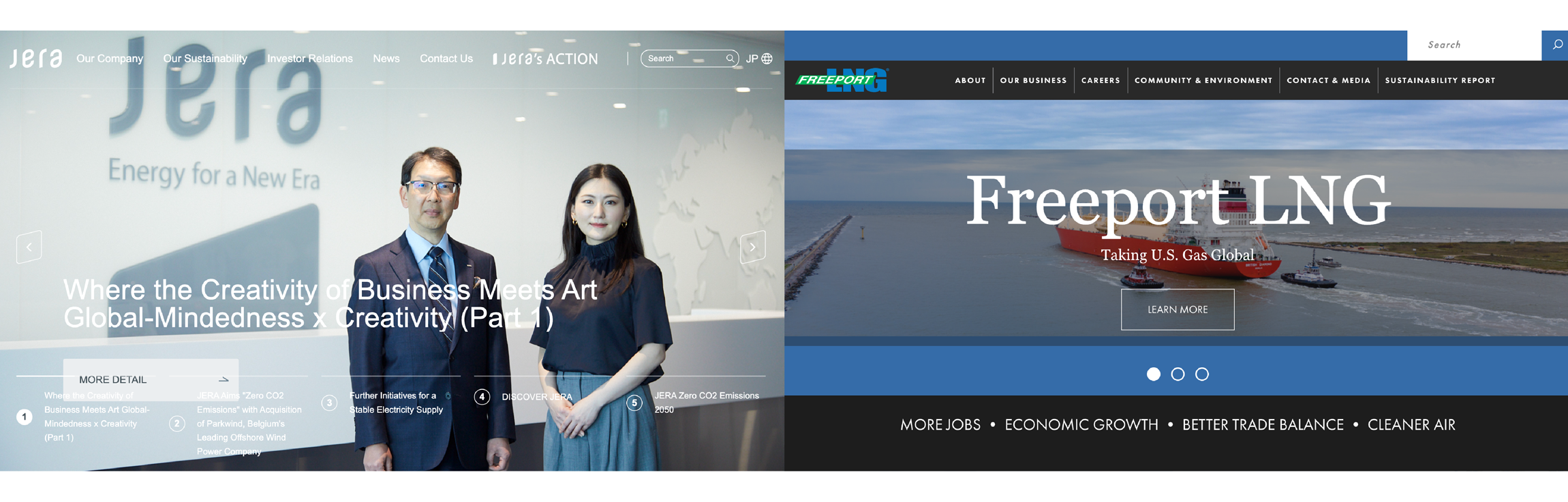

One example, in particular, epitomizes this trend.

In November of 2021, JERA Americas Inc. purchased the Freeport LNG Development—one of the largest U.S. exporters of LNG, or liquified natural gas. Post-deal, as of publication of this report, both brands remain independent, with individual, unlinked websites and unique visual and verbal identities—contradicting a property (the propensity to mix) of their lucrative resource.

The remaining 18% of transactions in the energy sector followed an acquisition strategy where one brand was absorbed into the purchasing brand.

This strategy was common when the acquirer already owned a portion of the acquiree. For example, in May 2022, Harvest Midstream bought out the remaining interest in Arrowhead ST Holdings from other venture partners. Post-deal, Arrowhead ST Holdings was fully acquired into Harvest Midstream, with no remaining independent brand assets, like the name, visual identity, or website.

Other branding strategies, such as creating a net-new brand or leveraging co-branding/endorsed branding efforts, occurred 0% of the time in the energy sector.

Insights

Within the energy sector, the most common branding decision by far was to keep both companies independent, with separate branding.

Why might this be? One word: age.

In general, energy companies are more mature at the time of the merger or acquisition, especially in comparison to other such industries as technology or healthcare. Unlike start-ups in other industries, these mature, purchased companies in the energy industry also have established cultures and brands.

Patience may be an important factor in a successful energy sector M&A. To ensure that two cultures are ready to either mesh or become something new, it is wise to patiently continue a separated branding strategy. David Reid, CTO and CMO of NOV, agrees.

“At NOV, we have pockets of brands that have run as separate brands for 10 years before fully buying into the culture and direction of the corporate NOV brand. They do their own thing and then eventually they recognize that it’s the right time to join the larger family.”

David Reid

CTO and CMO, NOV

Insights

In the energy industry, where the acquiree might be just as old or established as the acquirer, keeping brands separate for indefinitely gives more opportunity to truly assess culture and brand fit before moving forward. It also ensures customers that they’ll continue to receive the same service and quality products they rely on, despite the merger or acquisition.

How brand can drive success

The most outwardly visible role of brand in M&A is the change—or lack thereof—made to a company’s name or logo. Think hyphens and abbreviations that run rampant and amalgamated visual identities that read more chaotic than cohesive. Because this metric of change is so easily visible, it formed the foundation for our analysis of our M&A data.

Beyond changing those important identifiers, there is other, more nuanced and powerful brand work that can be done to ensure success of a new joint entity—for leveraging brand increases the likelihood of success of the merger or acquisition.

A merger or acquisition is a perfect opportunity to revisit a company’s mission, vision and values. What’s more, with new capabilities provided by the event, it is the perfect time to refresh the brand strategy and competitive positioning.

How brand can drive success

One way to do so is to embrace brand-led organizational change.

By assessing each company’s culture and creating a careful plan for integrating the best aspects of both entities, companies can optimize cultural integration, employee engagement, operational efficiency, and productivity. Engaging employees of both companies with a clear EVP and uniting them around a new shared goal yields better financial outcomes.

While an increase in M&A activity globally and in the U.S. was notable, even more notable were the resulting branding outcomes. Where we expected to see an increase in net-new brands created, we were surprised to see no net-new brands created in the U.S. industry sector (because of M&A). Retaining separate brands was far more represented in the energy sector than other industries we reviewed. As our energy experts explained, more mature companies in the industry tend to take a more steady and patient approach to brand merging or absorption during M&A.

However, whether two companies change their names or logos or not, there is still important culture and employee brand work that energy companies can embark on during the M&A process to ensure cultural integration, employee engagement, and operational efficiency.

Where do you stand?

Was brand integration discussed as part of the M&A negotiations?

Do you have M&A brand guidelines?

Have you had any internal conversations about brand integration strategy?

Do you have current equity research on both of the brands?

Has your research indicated whether either brand can stretch into the other brand’s territories?

Have you considered the cost of a brand change (both brand creation and brand implementation)?

Have the cultures of both companies been reviewed/analyzed for symmetries and best practices?

Where do you stand?