This article originally appeared in Performance Marketing World.

People tend to think that branding companies create brands, but the truth is they uncover them. It’s more like archaeology than construction, digging into the foundations to reveal the extraordinary and unique element that exists in every brand. Akin to the words of Oscar Wilde, “be yourself; everyone else is already taken”.

The word ‘truth’ in this context is multi-faceted. There is the core truth that serves as the foundation of the brand, but also the truth, or facts, that we rely on for making decisions around that brand.

Fact-based branding is a vital aspect of brand. Whether you’re refreshing a brand, or launching something new, testing and measuring allows you to remove the guesswork from decision-making.

Considerations for brand measurement

When considering brand measurement, it’s important to understand that it is a means to an end, and not an end in itself. Keeping this front-of-mind will help you to focus on the most important key points:

- Why am I doing this and what is the end goal?

- How will measurement support my decisions, and what role will that play?

- What is the most simple way of approaching this?

The question over alternative approaches to brand measurement is a common one. So, it is vital to understand the value that it brings to the boardroom. Most brand valuation methodologies share key inputs at their heart. Firstly, measuring brand performance which focuses on proprietary elements such as equities. Secondly, brand contribution, or the weighting and role of brand in decision-making. Finally, financial indicators, which look at technical economic metrics such as quarterly and annual reports.

Brand contribution, unlike other inputs, does not focus on landing on a single number but offers data from a survey providing a rich understanding of the metric. While you must wait for quarterly or annual reports with traditional brand valuation, contribution allows you to pull apart the underlying factors as necessary and understand the levers for injecting value. Now, enabled to cut brand contribution by different markets, audiences and sections of the business, you can influence decisions and focus on the real priorities such as creating brand value, and avoid measuring without any specific goal.

Supporting the numbers with qualitative research

Although numbers bring robustness to measurement, qualitative research offers richness. If we ask customers their brand preferences, we typically stop at the functional level. It’s cheapest, best, or most compatible being the common responses. However, for a competitor, it is these attributes that are easy to copy. So, we must get beyond to the emotional drivers behind these decisions to find the red thread that connects everything. This is your differentiator, and the most difficult aspect to copy.

With a level of structure, qualitative conversations differ from in-depth interviews. Focusing on the why, it begins at the rational level of customer decision making. If we build on the ideal brand within a category, based on the characteristics at that rational level we can push to understand the benefit to the customer. Uncovering the signature emotion through logic maps, we can visualize how people are making decisions and understand the profile of the ideal brand. By layering the client brand on top, we can then identify the gaps, allowing you to focus on the emotions and benefits of the research.

Brands need depth, breath, and to be holistic and rich. They also need an inside-out and outside-in perspective. Measuring employee sentiment is vital in creating a best-in-class employee experience, which in turn is key to a positive customer experience. Measuring employee commitment and motivation to organizational values is critical in this context. However, simply measuring commitment can disguise a misunderstanding within that measurement. While two employees can be measured to show positive commitment, their level of commitment may differ drastically.

Measurement to management: Driving customer loyalty

Customer loyalty is still one of the most desirable outcomes for marketers, with NPS [net promoter score] one of the most common languages of customer loyalty. However, NPS does not tell us how to influence it. This is where we refocus from brand measurement to management and offer NPS some help.

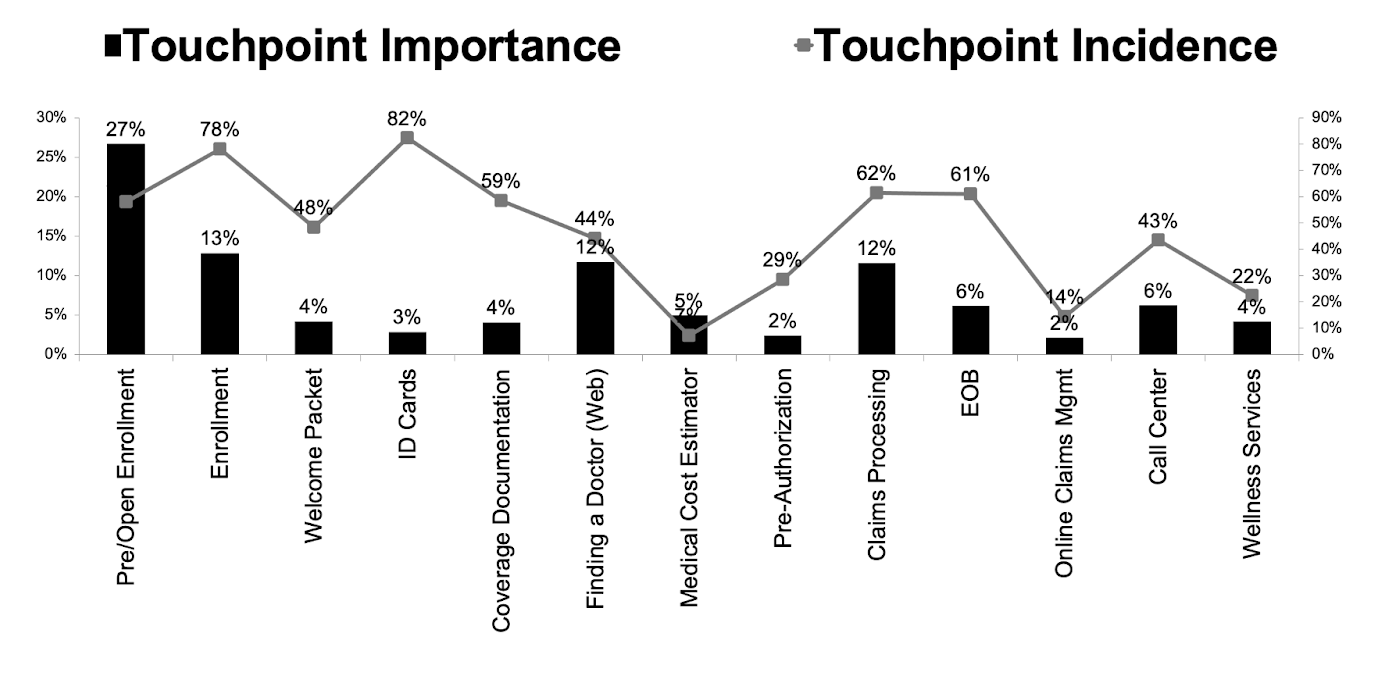

Measure the usage of every customer touchpoint in the journey, not just NPS via customer-focused surveys. Through journey mapping, you can measure performance around satisfaction, and begin modeling with these robust inputs. By measuring the higher and lower volume on relative incidents, we can measure the relative importance of Impact on NPS. Helping us identify where brand is working hardest and loyalty is created, you can build an improved experience and focus your efforts.

Understanding customer preferences

Asking a customer why they choose one brand over another, often the answer you get will be polite, exaggerated, diplomatic, or even a lie. Getting to the heart of how people make decisions is key to understanding.

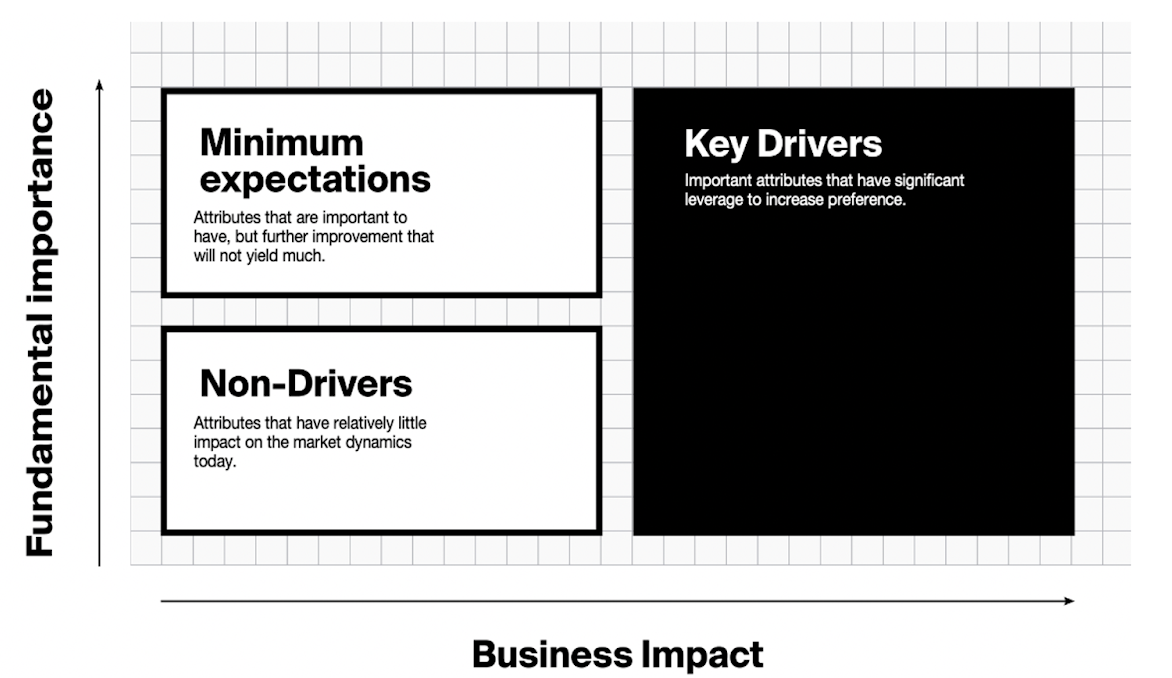

Modeling with independent variables as well as dependent allows you to focus on the building blocks, or attributes, of a brand. However, not all brands are equal. There is a need to surpass the drivers of preference from the attributes list. Dissecting the attributes and drivers help propel you into the future and explain decisions from minimum expectations. Often, people cite trust as a reason they choose a brand. With traditional drivers analysis this will come out on top. However, once you hit the minimum expectation of trust, you cannot unlock any incremental preference. There is trust or there is not. So, it is vital to focus on key drivers, including drivers that appear to have a low fundamental importance as they may grow in importance. Hardcoded now, they can become differentiating by default.

It’s all about timing

Measurement requires patience. There is a balance to be struck when aligning with the board. Utilize measurement, but also manage expectations. It takes time to gather data to effectively measure. Measurement should be more about foresight than hindsight.

Complexity is the enemy of measurement. Focus on what is critical, having an output that is going to create incremental value. Optimize the allocation of resources and move away from monitoring to focus on management. Brands that embrace simplicity will grow faster, and deliver something unique, fresh, and useful for the audience.

Ben Osborne is Head of Insights, EMEA