Across generations, everyone wants a name that signals connection and feels like it was built just for them.

Over the last two decades, marketers and branders have continuously tried to determine how to reach the new, younger generation. Millennials, also known as Generation Y, are the focus of so much brand research. Should brands be adapted to this generation and its specific desires?

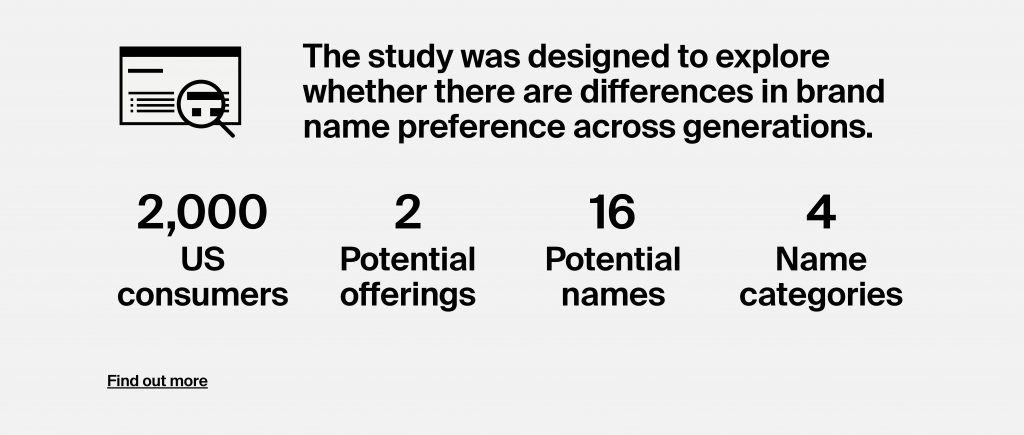

Many brands encounter this question when they’re creating a name for a company, product, or service. Are Millennials (born between 1980-1994), so distinctly unique in what they want or expectfrom a brand name when compared to Generation X (1965-1979) and Baby Boomers (1944-1964)? And what about the Centennials, also known as Generation Z (1995-2015)? How are their brand- name preferences different or the same from the previous three generations? One common belief is that younger generations expect things to sound young, hip, and cool. Text speak is often held up as an example of “youth speak.”