In SMPL Q+A, we interview practitioners on all things relevant to branding, design and simplicity. Here, we speak with our Client Director Rob Williams and Design practice about our recent work with electric vehicle charging company Mer.

Why did Statkraft approach Siegel+Gale?

Rob Williams: Statkraft, Europe’s leading renewable energy company, has been generating renewable energy since 1895. Following some recent acquisitions, Statkraft wanted to apply its renewable energy expertise to electric vehicle (EV) charging solutions, recognizing the changing landscape and importance of consumer preference on cleaner energy vehicles.

We first crossed paths with Starkraft in 2019, sharing an enthusiasm and commitment to developing a consumer-facing brand for an EV-charging network that was optimistic about the future, accessible to all and beneficial by nature. From this initial conversation, we began the journey of helping Statkraft create an international position in EV charging by 2025. Experiencing exponential growth through multiple acquisitions with Grønn Kontakt, eeMobility and E-Wald, it was clear a unique identity would be required. It was from this need that Mer was born.

Why was Mer created as a standalone brand?

RW: While Statkraft has a vast legacy that spans over 125 years across B2B energy (and deeply rooted in Norwegian heritage), to fully democratize clean EV charging, we would create a consumer-facing brand that would capture the engagement of EV-users across the globe.

We kicked off the project with some concept testing across different European markets to understand how the Statkraft brand could be experienced across their new charging network.

Mer was born, a brand fully owned and endorsed by Statkraft, representing powerful, positive and practical benefits to everyone it interacts with.

Design

What is the concept behind the logo and identity system?

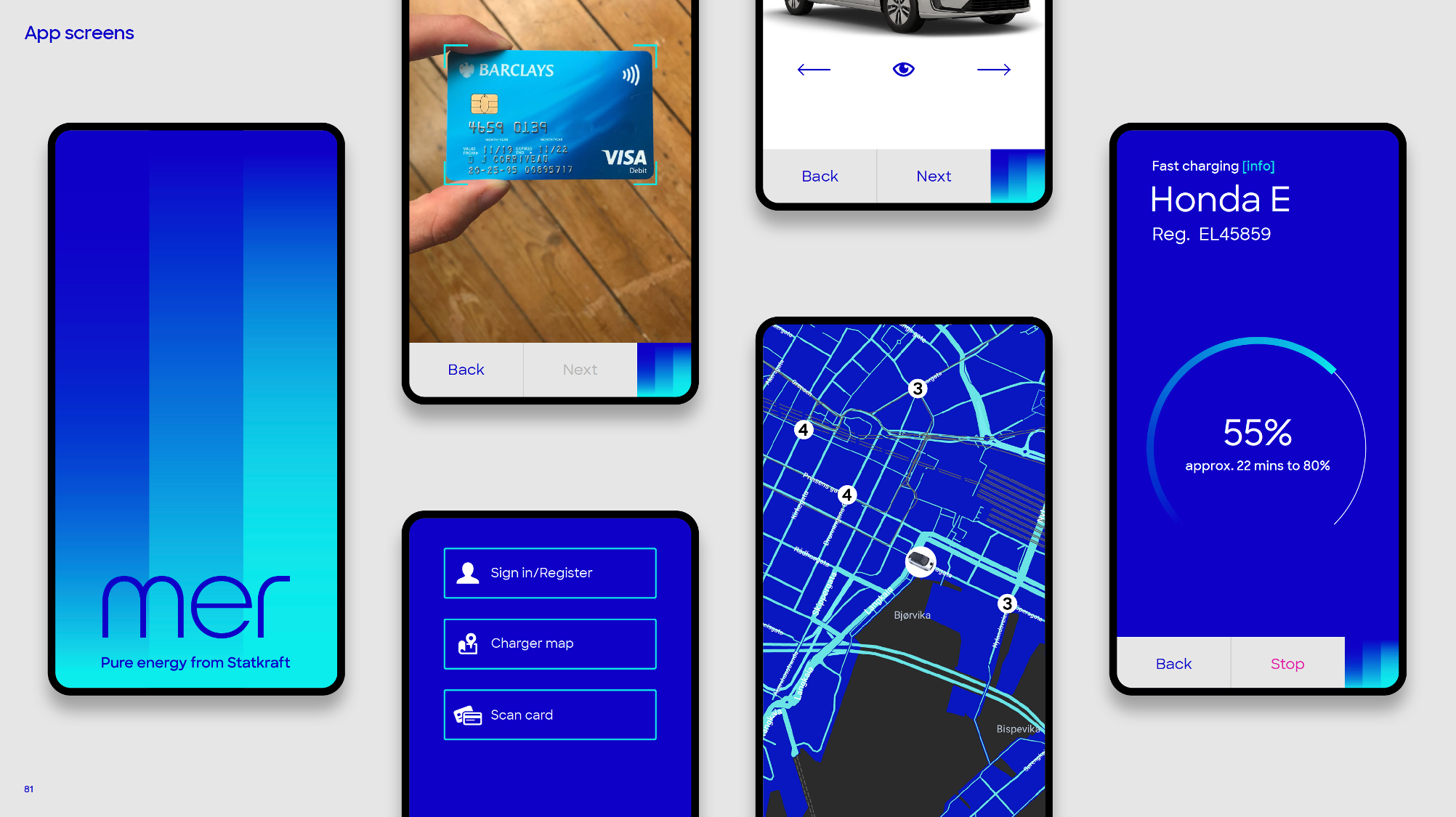

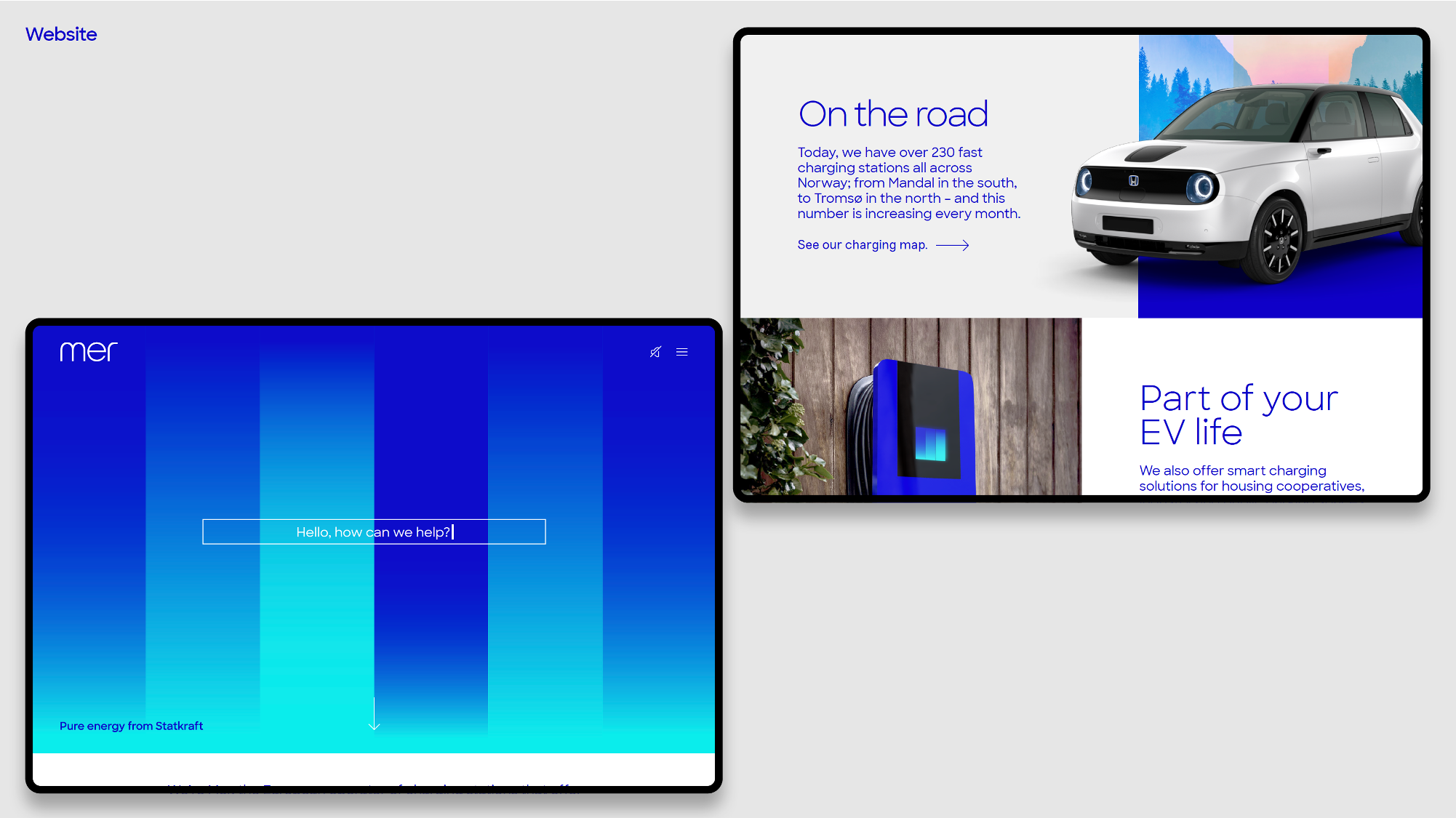

The concept behind the visual identity was moving perception away from EV adoption and aligning the brand with an EV lifestyle – something perpetuated by key aspects of the strategy and language. We discovered that, unsurprisingly, key among the many pain points of EV adoption is the lack of infrastructure currently in place and the additional vehicle charging time this creates. It was essential to investigate how EV ownership fits around lifestyle to reframe how driving an EV can be a cultural norm. We did this by creating a simplified experience with an identity that was as light and discrete as possible, demonstrating balance between life priorities and the role of the car.

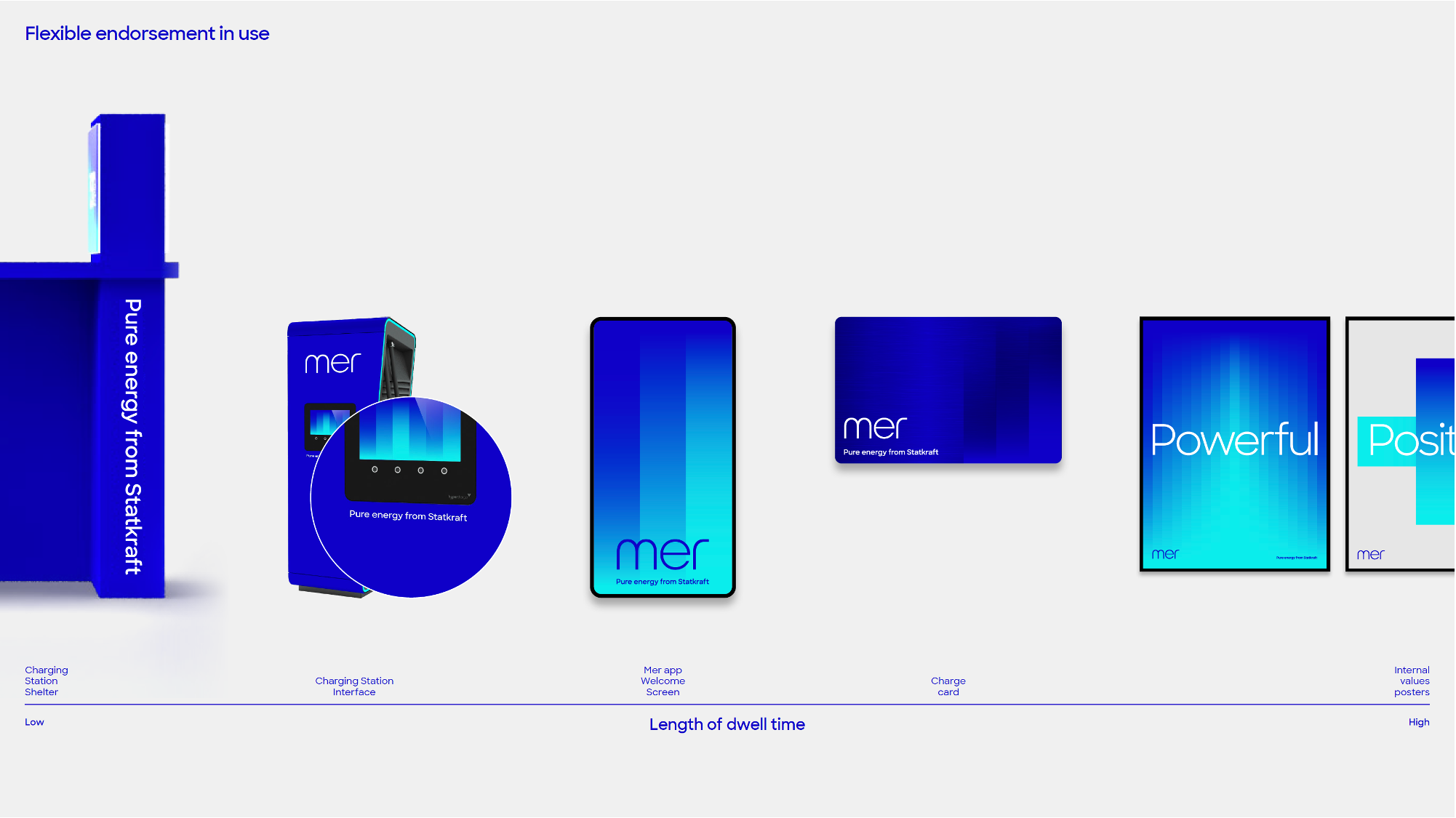

The logo reflects how the main brand generates power and moves to provide feedback to the user. This partners with a sonic branding identity where your Apple Watch informs you when an EV charging point has become available or when your battery is fully charged. The identity is either present or absent as appropriate, with all aspects contributing to demonstrate the benefits of using clean energy in an ‘EV lifestyle.’

What is unique about the brand voice?

We wanted the brand voice to showcase Mer’s passion and its ability to draw upon the vast knowledge and extensive history in renewable energy of Statkraft. We crafted a brand voice that was vibrant and sincere, combining a knowledge of renewable energy with enthusiasm and optimism, ensuring the hope for a sustainable future feels both genuine and inspiring.

We developed a brand voice that could effortlessly communicate with a wide array of stakeholders, from drivers to partners, from employees to businesses. Mer’s brand voice is based around three fundamental principles–powerful, positive and practical. We wanted the brand to feel accessible to everyone, effortlessly simple and just right.

How does the platform deliver on Mer’s promise?

Mer is about the right EV solutions at just the right time.

Statkraft wanted to develop a simple and more accessible experience for everyone, removing the complexities, the jargon and the barriers to renewable energy for vehicle charging.

Stations and services that feel smart, accessible and powered by a purer source from Europe’s leading renewable energy provider. Mer gives drivers a guilt-free, seamless way to power their journey by building power, positivity, and practicality into everything it does.

How does the brand prepare Mer for the future of this growing market?

RW: Mer is just getting started. Mer will continue to expand across different countries and regions, powering EVs with their renewable energy.

Mer is about balancing where we need to go with what is right—for businesses, for homes, for the planet—enabling businesses and partners to be better for their customers and their environment—inspiring their employees to be an active part of crafting a greener, smarter future.

To learn more, explore our Mer case study here.